The US-India trade deal is not just a headline. It directly impacts total landed cost modeling, supplier diversification strategy & negotiating leverage for North American procurement teams.

How does the India-US trade deal impact the global sourcing strategy?

North American manufacturers have been navigating

Ongoing US-China tariff pressure

Geopolitical instability

Rising labor costs

Supplier concentration risks

Margin compression

India has long been part of China+1 strategies. What changes now is the economic viability at scale – without sacrificing supplier depth or industrial maturity.

For sourcing leaders, this increases leverage – not just against China, but across the entire supplier base.

Is India operationally ready for manufacturing at scale for my programs?

Indian manufacturing is not just growing, but it is improving & developing evidenced by the massive growth of engineered goods and increasing exports over the last decade.

The Make in India initiative was announced in 2014, which has a few key components to grow & develop manufacturing across the country:

Industrial corridors (11) – logistics routes designed to connect different main industrial regions across the country

Special economic zones (276) – areas that have been built for manufacturing with strong infrastructure & incentives for manufacturers to develop parts / increase production [Top states are Tamil Nadu (40), Karnataka (31), Maharashtra (30), and Uttar Pradesh (14)]

Primary sectors (27) – these included Electronics, Automotive, Semiconductors, Renewables & others. Each sector has 2-3 regions that were identified to create a strong supplier network / hub for different industries

Since 2014, engineered goods exports have more than doubled from 55B to 116B last year, which signals a structural manufacturing maturity rather than temporary growth.

All of this makes India ready for manufacturing at scale, with the right infrastructure & government support / incentives to develop manufacturing capacity quickly as needed.

Which categories will benefit most from India-US deal for Automotive Procurement teams?

The biggest impact is in labor-intensive, tariff-sensitive categories, including:

Castings & forgings

Precision machining

Fabricated assemblies

Electrical & wiring systems

Automotive subassemblies

Renewable energy components

Industrial machinery components

These categories share two traits: high labor content with high freight weight. That combination makes them sensitive to even modest tariff shifts.

If a $40M annual fabrication category improves by 5–6% in landed cost, that’s $2–2.4M in annual margin impact.

What are the quality standards for manufacturers in India?

The attention to quality & development of quality management systems has increased across manufacturing sectors in India over the last 5-7 years. APQP & PPAP standards have become much more common across factories, especially the export manufacturers with an increased importance & awareness on it now compared to previously.

As automotive companies like Maruti Suzuki, Tata, Mahindra & other OEMs have grown, so has the importance of strong quality management systems that can protect against risk & develop suppliers ongoing.

For example, within the MESH network alone – over 1,260 Indian manufacturers have IATF & ISO certifications and serve automotive OEMs & Tier 1s.

What procurement leaders should do now?

Re-run total landed cost models with updated tariff assumptions

Identify categories with highest single country concentration risk

Benchmark 2-3 qualified Indian suppliers per critical category

Align engineering on alternative qualification timelines for new programs

Run structured, multi country RFQs across qualified suppliers

Benchmark pricing against global suppliers in that category

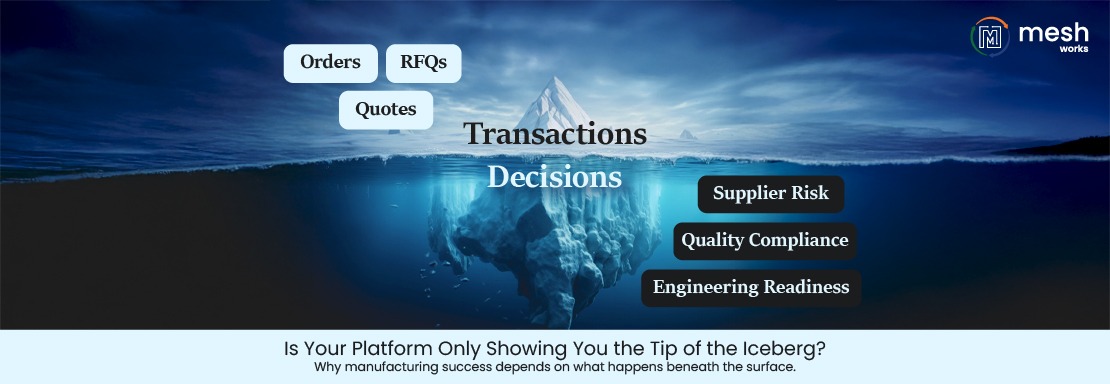

Digital sourcing platforms can accelerate this benchmarking process by consolidating supplier discovery, RFQ comparison & multi-country cost analysis into one workflow.

Digital sourcing platforms like MESH Works enable procurement teams to consolidate supplier discovery, compare RFQs across countries, validate certifications, and benchmark global pricing in one structured workflow.

If you are considering India for your next sourcing initiative, schedule a demo with MESH Works to conduct transparent, multi-country RFQs and make informed, data-driven decisions.