The India-EU trade agreement materially changes the landed cost equations for European automotive manufacturers.

With tariffs reduced or eliminated across key machinery & industrial categories, sourcing leaders must re-assess China exposure, high-duty metal categories, new program sourcing strategies & overall supplier concentration risk.

A highly publicized part of the deal was eliminating tariffs on 250,000 vehicles annually. But more importantly, India eliminated tariffs immediately on machinery & equipment.

Which automotive categories should EU buyers re-evaluate first?

Castings & forgings

Precision machined components

Fabricated metal assemblies

Electrical & wiring assemblies

Renewable energy components

Automotive subassemblies

What these categories have in common: high labor combined with high freight weight, which makes them historically more price sensitive.

This strengthens the economic case for expanding manufacturing and sourcing programs in India. For labor heavy components, even a 5-7% reduction can significantly shift the cost curve. So a 6% landed cost improvement on a €25M annual casting category would be €1.5M in annual margin impact.

Is India a sustainable long-term, reliable partner?

This deal has implications in a phased approach over the next 10-20 years. This agreement has been in the works at different points over the last 15 years. The signing & agreement of this deal means Europe is acknowledging India’s place as a significant partner in the future.

India is already a major exporter of castings, forgings, & automotive components to global OEMs with a strong Tier 1 & 2 supplier ecosystem. Areas like Delhi, Pune, & Chennai are heavily catering to the automotive segment already.

India’s engineered goods exports were $116.6 billion in FY2025 with US having a largest share of incoming goods around 20%.

All of this makes it a prime area to invest in for European automotive companies. The same way many North American manufacturers have also done this.

How does this affect China+1 strategies?

India eliminated the tariffs on many of the categories that EU has historically relied on China for. These are part of phase 1 eliminations, which was by design & part of the strategy.

From a logistics standpoint, India-Europe sea freight ranges on average 25-35 days, comparable to or slightly shorter then many China-Europe routes (30-45 days average). This reduces concerns around significantly extended lead times when diversifying supply, plus may increase working capital & cash flow when transit times are shorter.

The most immediate shift will occur in new program launches (NPI), where tooling has not yet been locked in & supplier approvals are flexible. Current production parts may be more difficult to shift, unless you build secondary tooling in India OR build a bank of parts. Also depends on the level of requalification / approvals needed from customers.

What should European automotive procurement teams do now?

Re-evaluate current tariff exposure & supplier risk areas

Evaluate India for suppliers in your top 5 highest spend or risk categories

Within those categories, decide the top 10-20 parts are most important to either move production to India or start dual sourcing from India

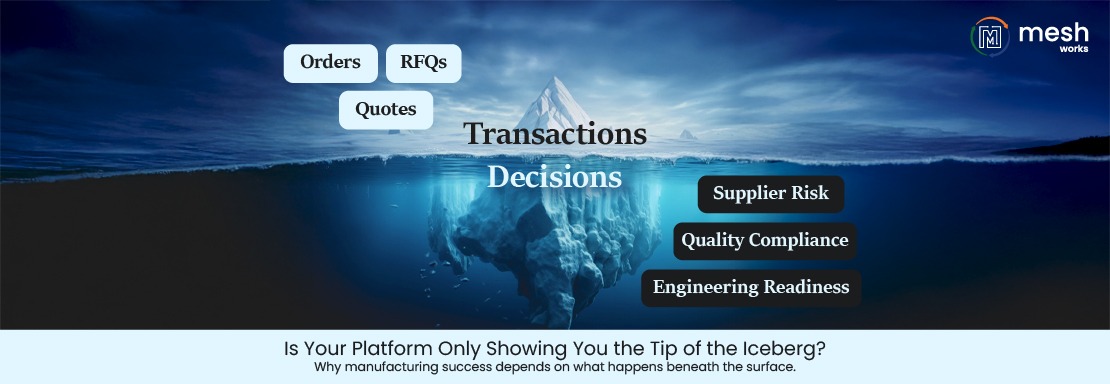

Invest in digital supplier discovery & evaluation tools to accelerate the process

As tariff structures shift, supplier discovery speed will become critical. Procurement teams relying on traditional ways of finding suppliers will fall behind.

Indian manufacturers are flooded with inbound opportunity from buyers right now. The US also signed a trade deal, which means European & North American buyers are going to be competing over capacity. Trade shifts reward companies that move early.

What risks should automotive procurement leaders watch out for?

While there are many opportunities that will come with this deal, it’s important to understand potential constraints & challenge that could come up in the future.

Indian capacity bottlenecks à If demand surges, it could represent issues if new manufacturing facilities cant be developed fast enough

Quality ramp up risk from new suppliers à As projects increase, there could be potential issues that rise from quality & new production runs

Intra-India logistics & port infrastructure à as volumes grow significantly, there could be issues with the transportation infrastructure within India & capacity at ports

Final Takeaway for European Automotive OEMs & Tier 1s

The agreement won’t automatically shift production. But it creates a structural cost advantage for Indian suppliers in labor-intensive manufacturing categories.

The OEMs and Tier 1’s that proactively model tariff impact, qualify suppliers early & embed dual sourcing into new programs will capture margin and resilience advantages.

Those who wait will compete for constrained capacity.

Digital sourcing platforms like MESH Works help procurement teams discover qualified Indian suppliers, run structured multi-country RFQs, and benchmark landed costs in one workflow.

Book a demo to evaluate India strategically in your next automotive sourcing program.